Email Sign Up For Our Free Weekly Newsletter

Second-home buyers out in full force as they continue to work remotely from vacation destinations

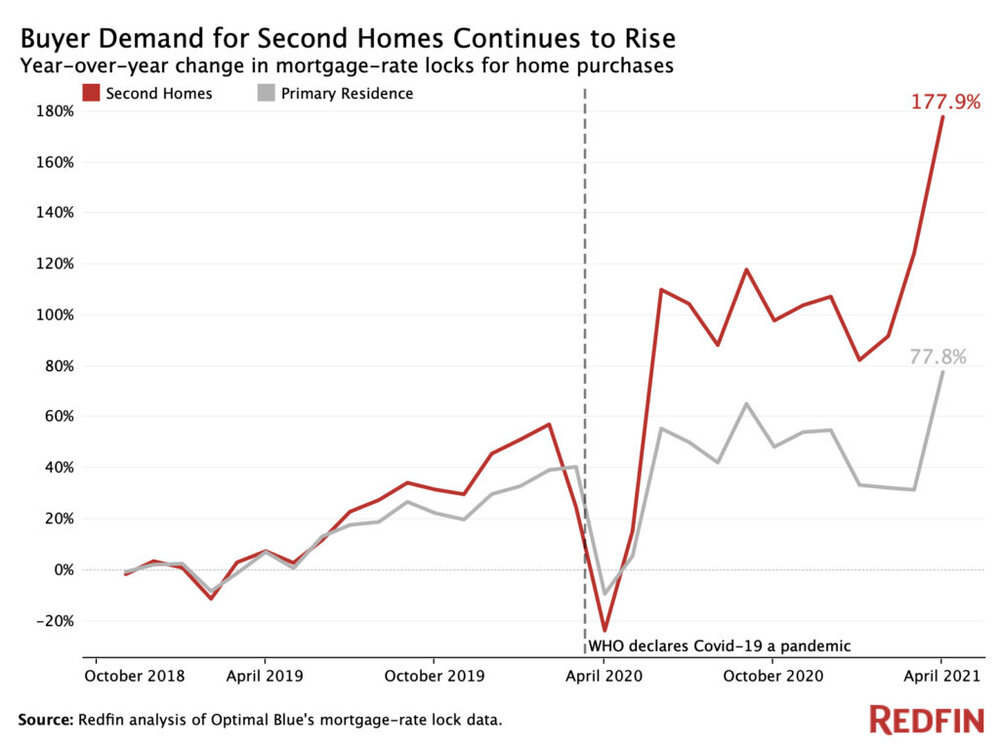

National property broker Redfin is reporting this week the number of U.S. buyers who locked in mortgage rates for second homes soared 178% year over year in April 2021, marking the 11th straight month of 80%-plus growth.

The record increase should be taken in context: It is likely exaggerated because demand for second homes dropped 24% year over year last April, the month after the coronavirus pandemic hit the U.S. and real estate activity in the country nearly ground to a halt. Still, second-home mortgage rate locks are holding steady at more than double pre-pandemic levels.

The rise in demand for second homes is more than twice the increase for primary homes, with the number of buyers who locked in mortgage rates for primary homes rising 78% year over year in April. That’s a record jump, too, but should also be taken in context, as demand for primary homes dropped last April due to the pandemic.

The data in Redfin’s report is based on the company’s analysis of mortgage-rate lock data from real estate analytics firm Optimal Blue. Demand for vacation homes remains elevated as wealthy Americans continue to have the freedom to work remotely and earn money from robust stock portfolios and rising home values. Even as some offices start to reopen, many Americans plan to work remotely for the long term, at least part of the time.

Daryl Fairweather

“The combination of the wealthy becoming wealthier, remote work turning into the new normal and low mortgage rates is creating an ideal environment for affluent Americans to buy vacation homes,” said Redfin Chief Economist Daryl Fairweather. “As long as the economy continues to grow, I don’t foresee demand for second homes slowing down anytime soon.”

The elevated demand for second homes in the pandemic era is one sign of economic inequality in the U.S., with some buyers able to afford second homes and others unable to become homeowners at all.

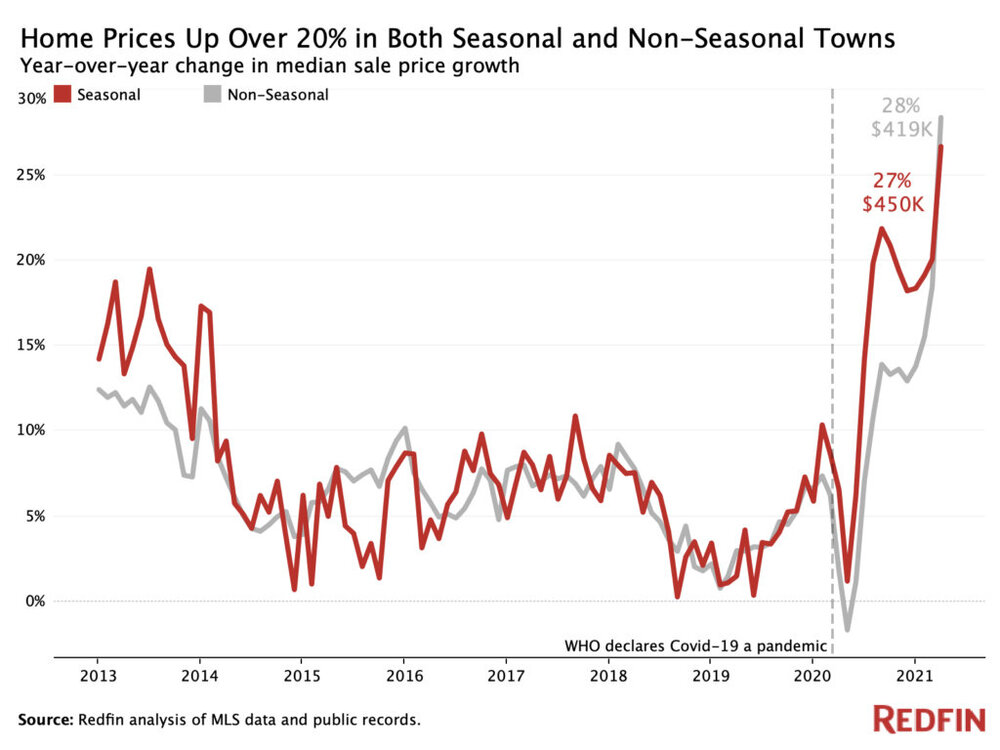

Home prices are up 27% year over year in seasonal towns

Home prices in seasonal towns, where second homes are often located, rose 27% year over year in April to $450,000. Prices in non-seasonal towns are up by a similar margin: 28% to $419,000. Though those jumps are both the biggest on record, the increases are somewhat inflated because price growth was slow at this time last year due to stay-home orders and economic lockdowns related to the pandemic. Non-seasonal price growth is slightly bigger than seasonal price growth this month partly because prices in non-seasonal towns dropped more significantly at this time last year.

Price growth for homes in seasonal towns started recovering last summer, and April marks the 10th straight month of 10%-plus year-over-year growth.